Quantitative evaluation of insights and breakthrough opportunities

Reasons for evaluating insights and breakthrough opportunities

Once the ability of an insight to deliver real promise has been validated, the scope of the demand space that it can occupy must then be evaluated. Awareness of this scope is absolutely crucial in order to provide guidance for the different decisions that the company has to make. To understand the scope of the demand space, a quantitative approach is required, presenting the insight to a significant number of customers and consumers in order to allow them to adopt their own position. The key here is to evaluate the insight, rather than the response that will be given to the insight, i.e. the concept). Quantifying insights can be a useful exercise for clarifying decisions at a very early stage in the innovation process or, further down the line, for more precisely targeting certain communication operations. When the future launch of a product or service is seen as a particularly strategic initiative, insight quantification is one of the key project management tools.

Setting up the evaluation process

After ensuring that the insights are clear, e.g. by means of qualitative interviews, a quantitative assessment will make it possible to prioritize the insights and to establish the profile of each one's target audience. This evaluation process is performed online, using a sample that we believe should be as wide open as possible, without an overly preconceived idea of the intended target. Our sole recommendation is therefore to avoid wasting time by questioning respondents who we can be sure in advance will not feel concerned by the insights. By adopting an open approach, it is possible to reveal the real core target for the insight, based on tangible results, rather than relying on suppositions and biased opinions that can lead to erroneous conclusions.The KPIs used for evaluating an insight will depend largely upon the company or brand strategy, and thus based on criteria that are highly individual. An initial and obvious indicator would be to examine the volume of consumers who recognize themselves in the insight that they are being asked to consider. This first KPI will establish the scope of the demand space but also make it possible to segment and typify the most appropriate audience. This exercise in itself can be extremely meaningful, given that it will confirm certain hypotheses, while also possibly invalidating others if it becomes clear that the insight corresponds to a different target group than that originally envisaged.

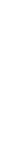

A second useful indicator centres on the amount of effort that consumers are willing to make in order to obtain a response to their insight. In other words, what are consumers ready to do to satisfy their expectations? The level of effort can be measured in different ways and depends to a large extent on the subject in question: this may be the extra amount of money that the consumer is willing to invest or their ability to change their consumption habits in order to correspond to the insight (but, once again, it must be stressed that this is not yet a product test). Indeed, it may become apparent at this stage that consumers recognize themselves with regard to certain insights but are not yet willing to "go the extra mile" in order to satisfy their need. In other cases, on the contrary, consumers are willing to make substantial efforts to obtain satisfaction. This second indicator pertaining to "effort made" enables us to draw up a relatively operational map of the demand space for the insight in question.

Especially in the very early stages of innovation, a mapping exercise of this kind makes it possible to better define the priorities among different potential insights and to anticipate the type of opportunities that they may open up. Such interpretation aids may provide useful input when deciding on the type and scale of the industrial project (and also deliver key pointers for the business plan).

Much further downstream in the process, at the communication stage, quantifying an insight helps to get a clearer picture of the type of audience that will be the most receptive or, from an alternative point of view, for an established target, to angle the pitch at the most appropriate level.

Other possible indicators

It goes without saying that other indicators can be used to refine the analysis and evaluation: e.g. the frequency of occurrence of the insight, the innovation effect that an insight solution may have, etc.… Once again, such additional indicators will be directly linked to the company's strategy and to the product/service categories into which it wishes to make a breakthrough.